Financial modeling: principles of development

In today’s world it is difficult to find two identical investment projects, especially if the projects are large and involve a large number of participants. As a result, it is difficult to find two identical financial models developed for such projects, since the specifics of each project (especially if artificial economics involved) must be reflected in the calculations. At the same time, the financial model should be coherent to all participants of the project (and not only its developer) – shareholders, lenders and the borrower (if debt is raised in form of project finance facility for SPV).

In our practice we have repeatedly faced complex business models, contradictory pricing principles, as well as exotic terms of key contracts, which should be reflected in the calculations – while keeping the financial model as simple as possible, clear and easy to use (sometimes we were also requested to do as fast as possible). The following principles allow us to achieve these goals and provide our clients with best results:

- Transparency

User of the financial model (representative of client or lender, “User”) must have an ability to see how input data affects the results of calculations (and which results depend on which input data)

- Comprehensibility

User must have an ability to determine parameters of the formula from scratch – without switching between several sheets

- Visualization

Financial model must use conditional formatting for highlighting target values, negative values, etc. That helps the user of the model to find the required information by color rather then searching through plain text

- Flexibility

Financial model structure must allow possibility of extension and detailing of results (revenue, operational costs etc. are calculated in different sheets)

- Convenience

Model must be easy to use. If iterative calculations or in-depth analysis are needed, we add “quality of life” macros to the financial model to allow scenario recalculation (or sequential calculation of several scenarios with switching of input data) with a single button push

- Individual approach

Financial model must be user-friendly: modeling results (financials, charts, etc.) must be easy to access and use, the use of the model for routine tasks (update of input data) must be comfortable to the user

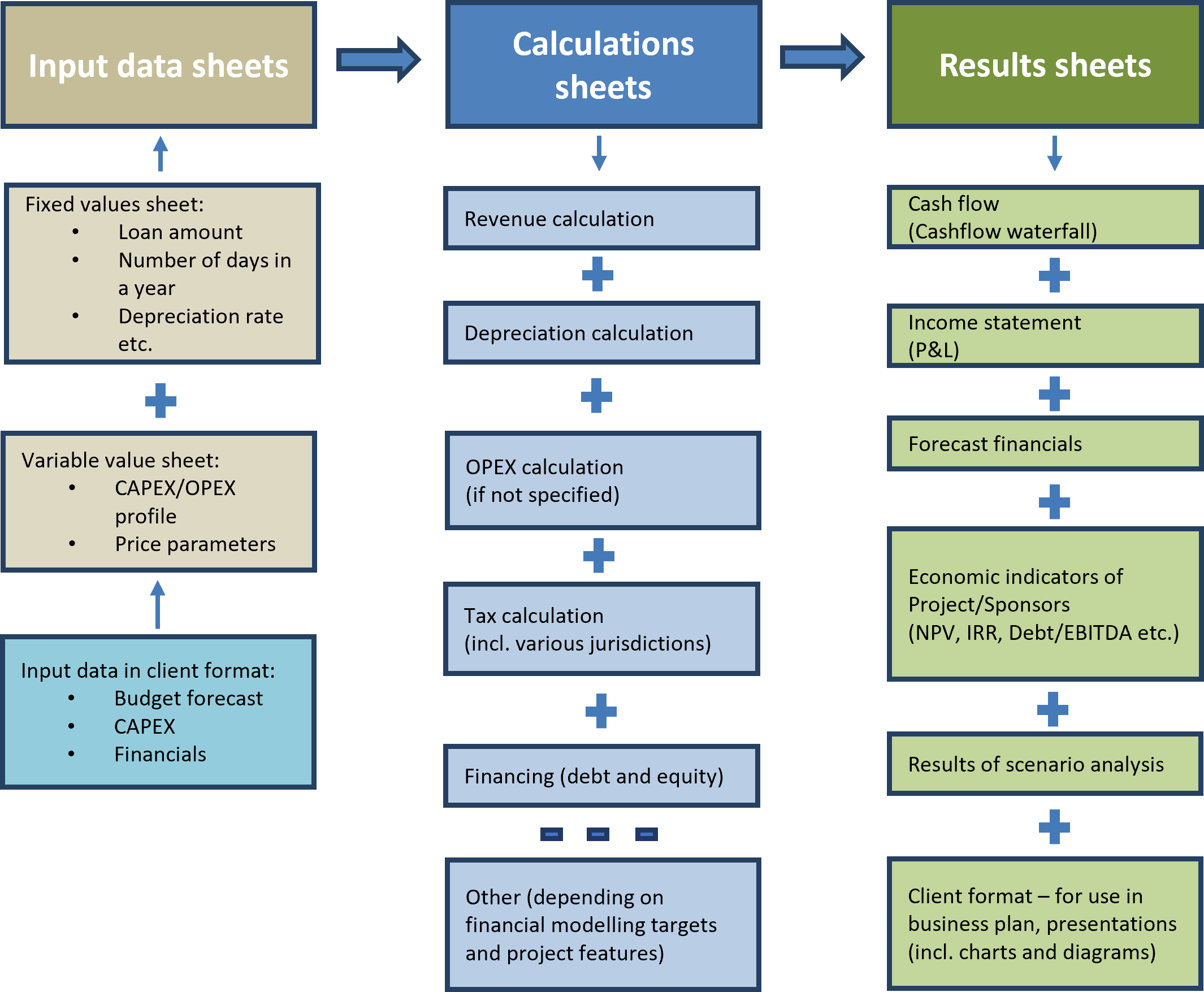

Simplified scheme of sheet structure in financial model*:

*Simplified scheme is an example of sheet structure in financial model; it can be adapted for the purposes of particular client by request.