Bystrinskoye gold-iron-copper ores field (Bystrinskiy GOK) (2013-2016)

Key information:

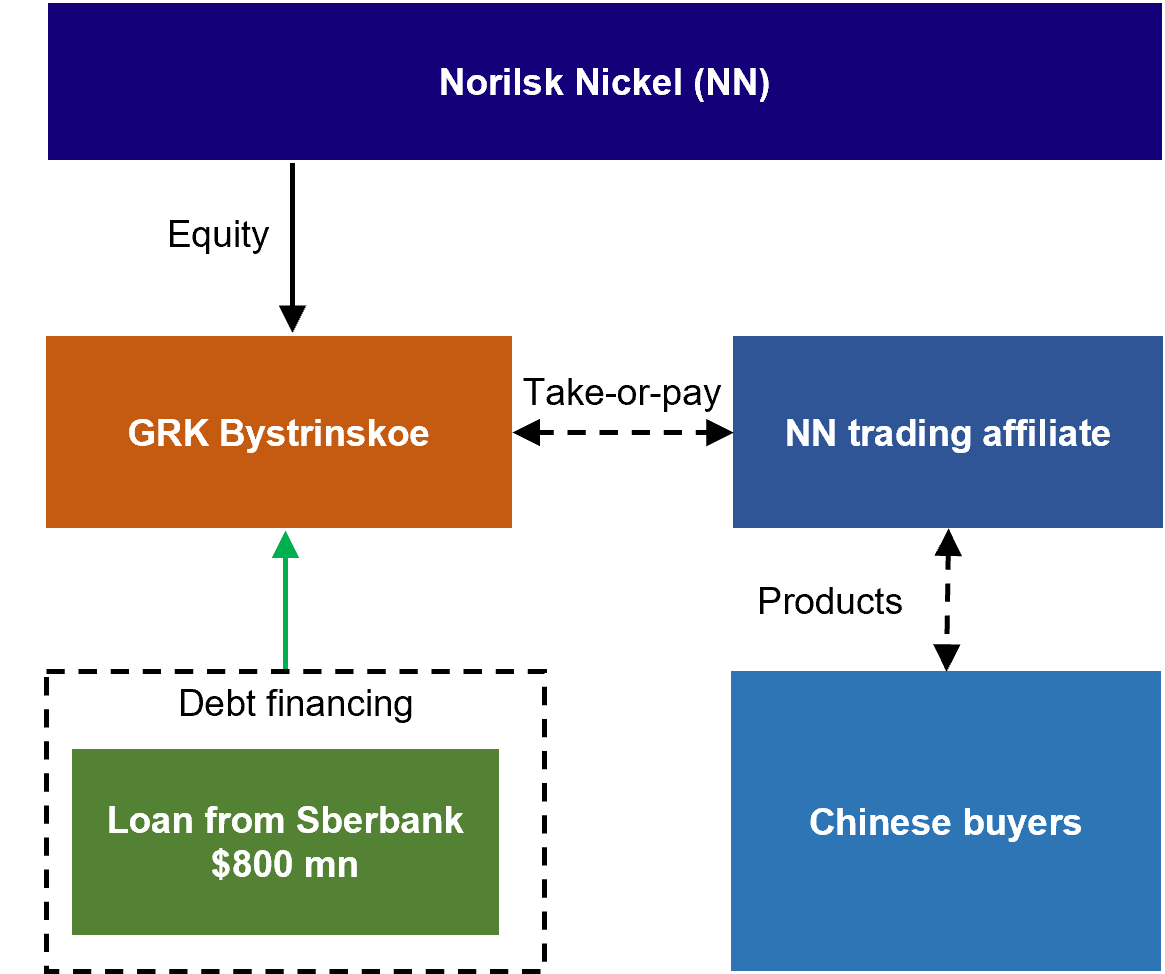

- Sponsor: PJSC Norilsk Nickel

- Borrower: LLC Bystrinskiy GOK

- Annual production and enrichment of 10 million tons per year

- Finished products – 300,000 tons of gold-copper concentrate and 2,8 mln. tons of magnetite concentrate per year

- Capital expenditure – equivalent to $1.4 bln

- Lender: Sberbank

- Financial consultant: RPFB

- Loan: USD 800 mln

- Loan tenor: 8 years

Organizational and financing features:

- VEB decided to raise financing after the sanctions, having received funding from Chinese banks in yuan

- RPFB participated in the development of a strategy to reduce price risks

- Application of the project financing scheme allowed to classify it as a first-class project

- The foreign investor is attracted

- Lack of a positive solution to the issue of financing the construction of transport and energy infrastructure delayed consideration of financing for 1 year

- Mining machinery quarry and park project was optimized

- RPFB was approved by the VEB Supervisory Board, but eventually the loan was received from Sberbank in US dollars

- Sberbank’s request for 50/50 project financing

- Sberbank’s demand to sign a «off-take» contract as a deferral condition for providing financing

- The role of RPFB helped to create a competitive environment among lenders and to improve credit conditions for borrowers

- Transaction based on Russian law

Bystrinskiy GOK – financing structure