Nord Stream (2008-2011)

Key information:

- 55 billion cubic meters of gas pipeline laid on the bottom of the Baltic Sea from Russia to Germany

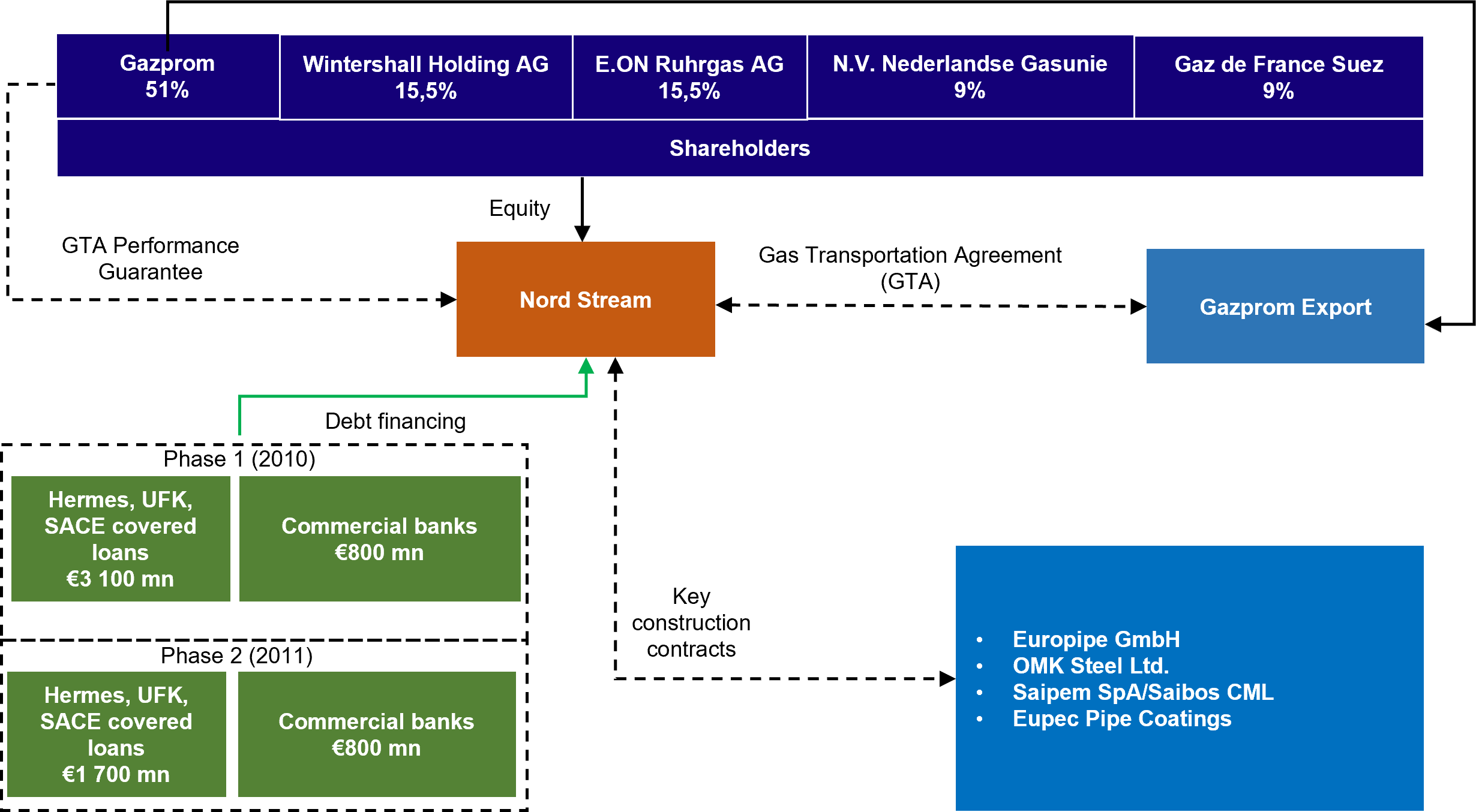

- Sponsors: Gazprom, Wintershall, E.ON, Gasunie, GdF/Engie

- Financial consultants: RBS, Commerzbank, Societe Generale, RPFB

- Debt financing: EUR 6.4 bn, incl. Phase 1 EUR 3.9 bn (2008-2009) and Phase 2 EUR 2.5 bn (2010-2011)

- Lenders: ECAs (Hermes, SACE), UFK, international commercial banks

Organizational and financing features:

- Untied public financing (Germany) (UFK program – support for energy security)

- ECA financing

- Untied government financing

- Phased commissioning – “expansion debt” regime

- Foreign strategic investor

- Limited recourse structure

- 100% long-term contract for the transportation of gas under the formula «transport or pay» with «Gazprom export», performance guarantee from «Gazprom»

- Artificial economics which guarantees the profitability of the project and provides the possibility of increasing the tariff to meet DSCR requirement

- Completion guarantee from Sponsors

- Revision of Phase 1 costs

- Untied financing UFK (Germany) (Energy Security Program)

- Refinancing of commercial loans with project bonds

- The deal was closed at the time of financial crisis in 2009, when the OECD Russia country rating was downgraded

- Refinancing of commercial loans with project bonds in 2017

Nord Stream – financing structure